Are there thresholds for reporting gambling winnings? Well, let’s dive into the exciting world of gambling and see what you need to know. 🎲

You hit the jackpot! But before you start spending those hard-earned winnings, there’s something you should know. 💰

When it comes to reporting gambling winnings, there are certain thresholds you should be aware of. Let’s take a closer look at what those thresholds are and why they matter.

Are there thresholds for reporting gambling winnings?

In the thrilling world of gambling, players are often left with one question: are there thresholds for reporting gambling winnings? The answer is yes, and understanding these thresholds is crucial for both players and the tax authorities. In this article, we will delve into the details of reporting gambling winnings, including the thresholds, regulations, and important considerations to keep in mind.

Thresholds for reporting gambling winnings: An overview

When it comes to reporting gambling winnings, the rules can vary depending on the specific jurisdiction. However, in most cases, there are thresholds in place that determine when and how much needs to be reported. These thresholds are typically set to ensure that the government has visibility into significant gambling activities and can properly tax them.

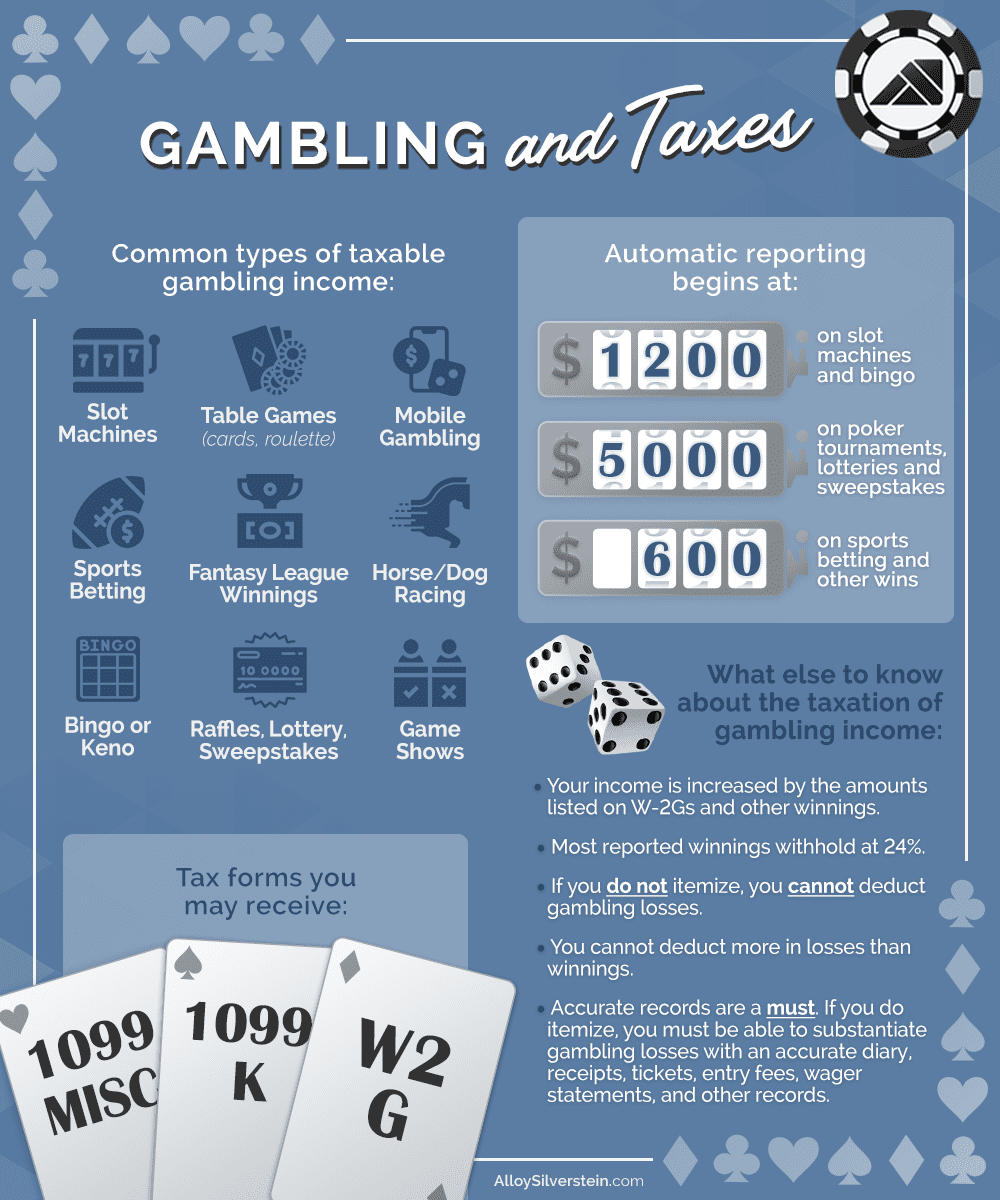

For example, in the United States, the Internal Revenue Service (IRS) requires reporting of gambling winnings above a certain threshold. As of 2021, the threshold is set at $600 or more in gambling winnings from any one specific game or wager. This amount includes winnings from casinos, lotteries, raffles, and other forms of gambling. It’s essential for players to keep track of their winnings and report them accurately to avoid any potential penalties or legal issues.

Understanding the reporting process

Reporting gambling winnings involves filling out specific forms, such as Form W-2G for certain gambling winnings or Form 1040 for general income reporting. It’s crucial to accurately report all gambling winnings, regardless of whether or not they exceed the threshold. Failure to report winnings can result in penalties, interest charges, or even legal consequences. By abiding by the reporting regulations, players align themselves with the law and ensure a smooth experience in the gambling world.

It’s worth noting that gambling losses can also be reported on tax returns, as they can offset the taxable gambling income. Players should keep track of their losses by maintaining accurate records, including receipts, tickets, and other relevant documentation. While losses do not necessarily need to be reported unless winnings are also reported, keeping a thorough record can provide tax benefits in certain cases.

Benefits of reporting gambling winnings

Reporting gambling winnings may seem like an additional effort or burden for players, but there are several important benefits to doing so. Firstly, reporting winnings accurately and timely ensures compliance with tax laws and regulations, reducing the risk of penalties or legal complications.

Moreover, accurate reporting allows for transparency and accountability within the gambling industry. This helps prevent money laundering, fraud, and other illicit activities. It also provides valuable data for tax authorities and regulators to monitor and regulate the industry effectively.

Reporting gambling winnings also provides players with a sense of security and peace of mind. By following the rules and submitting the necessary documentation, players can ensure that their activities are legal and transparent.

Tips for reporting gambling winnings effectively

Now that we’ve explored the thresholds and importance of reporting gambling winnings, let’s discuss some tips to ensure an effective reporting process:

- Keep accurate records: Maintaining detailed and organized records of all gambling activities, including winnings and losses, is crucial for accurate reporting.

- Consult a tax professional: If you’re unsure about the reporting requirements or have complex gambling transactions, seeking advice from a tax professional can help navigate the process.

- Stay updated on regulations: Tax laws and reporting requirements may change over time, so staying informed about the latest regulations ensures compliance.

- Use electronic records: Utilizing digital platforms or software designed for tracking gambling activities can streamline the reporting process and make record-keeping more efficient.

By following these tips, players can navigate the reporting process with ease and ensure their compliance with tax regulations, providing a hassle-free gambling experience.

Common questions about reporting gambling winnings

What happens if I don’t report my gambling winnings?

Failure to report gambling winnings can result in penalties or legal consequences, depending on the jurisdiction. The specific penalties may vary, but they can include fines, interest charges, and potential audits by tax authorities.

Are there any exceptions to reporting gambling winnings?

Some jurisdictions may have exceptions or lower reporting thresholds for certain types of gambling activities, such as casual bets among friends or small-scale raffles. It’s crucial to understand the regulations specific to your jurisdiction to determine any exceptions or variations in reporting requirements.

Can gambling losses be deducted from taxable income?

In some cases, gambling losses can be deducted from taxable gambling income, offsetting the overall tax obligation. However, specific regulations and limitations may apply, and it’s advisable to consult a tax professional to fully understand the deductibility of gambling losses.

Conclusion

Understanding the thresholds for reporting gambling winnings is essential for both players and tax authorities. By accurately reporting winnings, players comply with tax laws, ensure transparency in the industry, and benefit from a sense of security in their gambling activities. Remember to keep detailed records, stay updated on regulations, and consult a tax professional when needed to navigate the reporting process effectively. Reporting gambling winnings not only aligns with legal obligations but also contributes to a thriving and regulated gambling environment.

Key Takeaways: Are there thresholds for reporting gambling winnings?

- Reporting thresholds for gambling winnings can vary depending on the type of gambling activity and the amount won.

- In general, if you win $600 or more from a single gambling activity, such as a casino slot machine, you are required to report it to the IRS.

- For table games like poker or blackjack, you must report winnings of $5,000 or more.

- However, even if your winnings are below the reporting threshold, it’s still a good idea to keep track of your gambling activities and winnings for your own records.

- Remember, reporting gambling winnings is important to stay in compliance with the IRS and avoid any potential penalties or audits.

Frequently Asked Questions

Welcome to our FAQ section on reporting gambling winnings! If you’ve ever wondered about the thresholds for reporting your gambling winnings, you’ve come to the right place. We’ll answer some common questions to help you navigate this topic with ease.

1. What are the thresholds for reporting gambling winnings?

When it comes to reporting your gambling winnings, the thresholds depend on the type of income you receive. If you win $1,200 or more from a slot machine or bingo game, or $1,500 or more from a keno game, you are required to report those winnings to the IRS. For table games like blackjack or poker, you are responsible for reporting any winnings of $600 or more at a casino.

It’s important to note that even if you don’t meet these thresholds for reporting, you are still required to report your winnings as taxable income. Honesty and accuracy in your tax reporting are crucial, regardless of the specific thresholds.

2. What happens if I don’t report my gambling winnings?

Failure to report your gambling winnings can have serious consequences. The IRS requires you to report all your gambling winnings, and deliberately not doing so can result in penalties and legal trouble. Tax evasion is a serious offense that can lead to fines, criminal charges, and even imprisonment.

Additionally, if you are audited by the IRS and they discover unreported gambling winnings, you may be required to pay back taxes, penalties, and interest on the unreported income. It’s always best to comply with tax laws and accurately report your gambling winnings to avoid any unwanted complications.

3. Do I need to report gambling winnings for non-cash prizes?

Yes, you are required to report the fair market value of non-cash prizes as part of your gambling winnings. This includes prizes such as cars, vacations, or any other non-monetary rewards you may have won through gambling activities. The fair market value can usually be determined by researching similar items or consulting with an appraiser.

Remember to keep accurate records of all the non-cash prizes you receive and report their fair market value accordingly on your tax return. By doing so, you will fulfill your reporting obligations and ensure compliance with the IRS.

4. Can I deduct my gambling losses on my tax return?

While you can report your gambling losses on your tax return, the IRS has specific requirements for deducting them. You can deduct your gambling losses only if you itemize your deductions, meaning you forego taking the standard deduction. Additionally, your losses can only be deducted up to the amount of your gambling winnings.

It’s important to keep detailed records of your gambling losses, including receipts, tickets, or any other documentation that proves your losses. Remember to consult with a tax professional to ensure you are following the IRS guidelines for deducting gambling losses correctly.

5. Are there any exceptions to reporting gambling winnings?

While reporting gambling winnings is generally required, there are a few exceptions. If your winnings are from a state lottery, you don’t need to report them to the IRS for federal tax purposes. However, you may still be required to report them on your state tax return, so check your state’s specific regulations.

It’s always recommended to consult with a tax professional or refer to the IRS guidelines to ensure you understand the reporting requirements based on your personal circumstances. Reporting your gambling winnings correctly is essential for staying compliant with tax laws and avoiding any potential penalties.

Know what thresholds are in place for reporting gambling wins to the IRS

Summary

Here’s what we learned about reporting gambling winnings. When it comes to the IRS, any gambling winnings over $600 must be reported. However, each state might have different rules, so it’s essential to check with your state’s tax agency.

In some cases, even if your winnings are less than $600, it’s still a good idea to report them. This is because reporting your winnings helps establish a record and ensures you’re compliant with the law. Remember to keep track of your losses too, as you may be able to deduct them.